A Metric That Merits More Attention—Your Used/New Sales Ratio

When I was a dealer, we thought we were doing a pretty good job if we managed a .5:1 used-to-new-vehicle sales ratio.

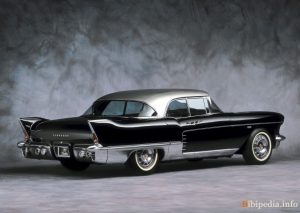

If we retailed 50 new Cadillacs a month, I expected that we would also sell 25 used units, which were almost always Cadillacs.

If we retailed 50 new Cadillacs a month, I expected that we would also sell 25 used units, which were almost always Cadillacs.

A recent Automotive News piece suggests that, since I was a dealer 20 years ago, the used-to-new vehicle sales ratio for many dealers hasn’t significantly changed—despite my sense that most dealers express a clear desire to retail more used vehicles to offset growing margin compression in their variable operations.

So what gives? Why haven’t dealers been able to make more significant gains in used vehicles? What known/unknown factors might be holding them back?

These are the questions that came to mind reading the Automotive News article. It focused on the used-to-new-vehicle ratios among its top 100 dealership groups. Less than 20 groups—18, to be exact—achieved a 1:1 used-to-new ratio and, among those, only nine achieved a 1.25:1 ratio.

My Cox Automotive colleague Les Abrams shares my view that, for today’s dealers and margin compressed market, a 1:1 ratio suggests you’re doing a “good” job, and a 1.25:1 (or better) ratio indicates a “great” job.

Such performance levels help you light up what I’ve long called the “wheel of fortune” in your dealership—the gross profit opportunity every retail used vehicle sale represents for your service/parts department, your F&I office, your used car department and, yes, for your new vehicle department.

But these higher levels of performance appear elusive. National Automobile Dealers Association (NADA) data shows that while the used-to-new-vehicle ratio has nudged forward in recent years, it seems to stubbornly hover around .75:1.

For the past 10-plus years, I’ve been blessed with the opportunity to help dealers improve their used vehicle performance, in part by encouraging them to make the 1:1 ratio a primary objective. My work has also allowed me to see and understand why some dealers struggle to make the wheel of fortune spin faster at their stores.

Here are three common factors that diminish used vehicle performance:

A front-end vs. “total gross” mentality. I’ve long made the case that today’s market is too efficient and transparent for dealers to get the front-end gross profits they believe their used vehicles should deliver. They get frustrated, and they double down on the “let’s get gross” strategy. Unfortunately, today’s market isn’t likely to reward traditional gross-building tactics like waiting for the right buyer, or setting your asking prices above the market. Both tactics result in older-age units, deeper “get ‘em out of here” spiffs and discounts and less overall profitability. These tactics also slow the wheel of fortune.

The better way, I believe, is that dealers should adopt a more investment-minded, total gross mentality. With it, dealers learn to take losses and low-gross deals in stride. Their average front-end gross is important. But it’s even more important that they turn used vehicle inventory to generate consistently higher returns across every dealership department.

Too-picky vehicle preferences. Some dealers are pretty picky about the used vehicles they’ll retail. They’ll pass on units their market wants in favor of those they prefer to sell. To some degree, this thinking makes sense, given dealer desires for differentiation and specialization. But top-performing used vehicle retailers have long ago shed their preferences in favor of market and financial particulars that affirm they can quickly retail a vehicle, and make money, if they acquire it.

A related point: I understand some dealers face factory pressure to meet certified pre-owned volume targets, which can tie up capital and management attention that might be better deployed on different inventory. To be sure, dealers need to play ball with the factory. But let’s remember: It’s your ball, and your playing field.

Process inefficiencies. Every used vehicle department has a lot of moving parts and processes, each of which affects the other. Whenever I hear a dealer share his/her struggle to improve their inventory sales velocity and turn, we’ll often uncover unnecessary inefficiencies with appraisals, reconditioning, merchandising and pricing. Dealers must recognize that in today’s more efficient market, time to market and time on market, must be compressed to maximize performance and profitability.

I hope this discussion helps you assess where your current used-to-new-vehicle ratio stands, and craft next steps to improve your used vehicle performance through the remaining months of this year.

After all, in today’s unforgiving market, if you’re not getting better, you’re getting worse.