A Calculation to Cross-Check Your Used Vehicle Inventory Levels

It’s been impressive to see dealers retailing more used vehicles despite the smaller inventories many have been forced to carry due to lower-than-usual availability of wholesale supplies.

Across the country, the days supply of used vehicles in dealer inventories has stayed below 35 days for much of the past four months; the days supply would be typically be roughly 45 days. During the four-month stretch, many dealers have been able to out-sell their year-over-year monthly volume totals as retail demand, despite some dips and drops, has remained strong. As I noted in a recent post, this stock-to-sales streak may well mark a historic first for dealers in terms of their collective inventory investment efficiency. Dealers have proven that they can sell more vehicles with less inventory.

But this achievement doesn’t mean dealers wouldn’t be acquiring more inventory if they could. Indeed, I continue to hear frustration from dealers that if they were able to acquire more used vehicles, they’d be able to sell the cars.

I appreciate this perspective. It reflects the opportunistic nature of many dealers. When their instincts suggest an opportunity, dealers go after it at full throttle. In fact, dealers who were able to act quickly in the early stages of the COVID-19 pandemic had a field day. For a brief time, these dealers were able to acquire inventory at historically low costs and sell them in a market where retail prices hadn’t really moved. These dealers enjoyed front-end gross profits that were far healthier and richer than many had seen in years.

Through all this, dealers haven’t worried as much about if/when the market might slow down. They’ve been too busy selling cars to consider darker, what-if scenarios that, in the moment, seem too distant for any significant concern. Dealers are more focused on replacing the cars they’ve recently sold to maintain their respective runs of retail sales.

But I’ve been advising that dealers should exercise care and caution as they replenish their inventories, since no one can be sure what the next 30 days will bring. Will it be the same or better than the last 30 days? Will it be a whole lot worse? There are a lot of factors in play. COVID-19 cases remain high. Federal unemployment benefits and bonuses have waned, at least for the moment. Unemployment claims have diminished, but the nation is still losing more jobs on a monthly basis than it did during the Great Recession that started in 2008. On top of all that, retail sales of used vehicles seem to have hit a lull in recent days.

There are a lot of unknowns. Given this backdrop, I’m advising dealers to run two comparative calculations to determine the appropriate inventory levels in the current moment.

The first calculation is your rolling 30-day total of retail sales. The calculation is as straight forward as it sounds: On any given day, you tally up the past 30 days of sales, and compare it to your current inventory. If your sales number is higher than your current stock, you effectively know how many vehicles you need to acquire to maintain your retail sales pace.

The second calculation serves as a cross-check on the rolling 30-day number. The calculation takes your rolling 14-day total of retail sales, divides that number by 14 to achieve a daily sales rate and multiplies the daily rate by 30 to give you a 30-day view. I’m encouraging dealers to compare the rolling 14-day and 30-day calculation and note the difference.

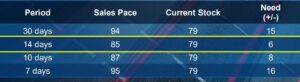

For example, I recently conducted this exercise with  a Southeast dealership. The rolling 30-day calculation showed the dealer needed 15 cars to meet the window’s projected sales pace of 96 units. Meanwhile, the 14-day calculation showed the dealer should only acquire six vehicles, given what had been a relatively slower period of recent sales (see chart at right).

a Southeast dealership. The rolling 30-day calculation showed the dealer needed 15 cars to meet the window’s projected sales pace of 96 units. Meanwhile, the 14-day calculation showed the dealer should only acquire six vehicles, given what had been a relatively slower period of recent sales (see chart at right).

The dealer opted to split the difference and acquire 10 vehicles—a decision that reflected the dealer’s belief that he might make up the difference by acquiring a few more trades than he had in recent weeks, and the dealer’s desire to ensure a leaner inventory if the market suddenly went south.

Some dealers don’t think the 14-day cross-check calculation is necessary. They prefer to use their rolling 30-day total as the sole means for determining how many vehicles they should stock. I’m not here to suggest this approach is incorrect. In fact, I’d submit it’s far better than stocking a 45- or 60-day supply of inventory, a strategy that can leave dealers too long in inventory if the market suddenly slows down.

My overall point is that, in a market where no one can know how the market might turn and how quickly a turn might occur, dealers should assess as many data points as possible to make the best decisions.