3 Ways To Power Through The New Car Sales Plateau

Maybe it’s the sub-zero temperatures or forecasts of heavy snow across the country. Or maybe dealers are getting smarter.

Either way, there’s a bit of cold, hard reality in the air.

More analysts and dealers are recognizing that while 2016 should be a decent year, it won’t be as good as 2015 or the previous couple years. There’s growing doubt that we’ll see another consecutive year when new vehicle sales volumes climb by 1 million or more units.

It’s curious that, in the span of a few weeks, the outlook has shifted from rosy to reserved.

The key question for dealers, of course, is how to sustain the prior year’s performance and profitability in new vehicles at a time when sales volumes plateau and market forces continue to compress dealer margins.

The answer lies in achieving greater efficiencies in your new vehicle operations, and providing greater ease to the customers you sell and serve.

Here are three areas where current inefficiencies offer opportunity for dealers to profitably power through a new vehicle sales plateau:

Increased transparency: The big losers in a less robust new vehicle market will be dealers who continue to resist the more market- and transaction-transparent pricing new vehicle buyers want to see. Industry stats show that dealers who adopt a new vehicle pricing strategy that accounts for the competition, available incentives and their own discounts see more engagement with potential buyers (e.g., vehicle details page (VDP) views, completed forms, e-mail leads) than those who don’t.

The prospective buyer’s desire for increased transparency also extends to the online marketing and merchandising of the vehicle. It’s all too common to see new vehicles posted online with stock photos, ho-hum descriptions and poorly thought placements on classified sites and landing pages.

Dealers would do well to put themselves in the buyer’s shoes: Would you be more likely to lock in or look past a new car listing that raises more questions than it answers?

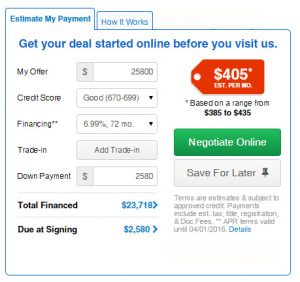

Online deal-making: Today, most dealers have some type of interactive tool on their websites that’s meant to help customers put themselves in a new vehicle. Instant messaging. Payment calculators. Trade-in evaluation tools.

Online deal-making: Today, most dealers have some type of interactive tool on their websites that’s meant to help customers put themselves in a new vehicle. Instant messaging. Payment calculators. Trade-in evaluation tools.

But here’s the puzzler: Why is it that only 30 percent of prospective new vehicle buyers actually use these tools? The answer can’t be that buyers don’t want the information. We know they do. To some degree or another, they always have.

The problem is that dealers typically don’t use these tools to truly give buyers the information they want. Instead, the tools serve the dealer’s appointment-setting and lead generation efforts. They exist to capture customer information and drive showroom visits rather than address questions and provide credible answers.

The important take-away is that dealers should recognize the efficiency (and online technology investment) gains they’d achieve by using tools to facilitate at least part of a transaction online.

Large public dealer groups, and many progressive dealers, have made online deal-making a strategic priority in the coming year for two reasons.

First, it builds credibility and trust with buyers. They understand when dealers are trying to make the job of purchasing a vehicle easier on their behalf. Second, it increases the efficiency of their sales operations. If buyers can work out key terms of a deal online, sales associates can spend less time working deals with managers and more time satisfying the customer’s desire to get to know and test drive the vehicle, and take delivery.

Showroom Reinvention: Dealers who address the first two inefficiencies are best poised to take full advantage of the third opportunity—making the customer’s time in the showroom more easy and efficient. It seems as if dealers have a hard time believing, or even understanding, that a customer really is largely “sold” on a vehicle by the time they arrive at the showroom, thanks to all their effort and research online.

In most showrooms, the sales process hasn’t changed much in at least 20 years. Today’s buyers really don’t like the typical cat-and-mouse deal-making. They have a number in mind, if not in hand, for the vehicle’s purchase price and, if applicable, their monthly payment.

When dealers come to terms with this reality, they find that it’s both possible and prudent to complete transactions in 60 to 90 minutes or less. In turn, customers are more satisfied and receptive to options that allow them to personalize their new vehicle or protect its long-term value.

Dealers who have already addressed these inefficiencies aren’t worried too much that new vehicle sales volumes will plateau in the coming year. In fact, they welcome it as an opportunity to distance themselves from the closest competitor as they both race to meet the needs of today’s customers.