Where Dealers Get Their Most Profitable Inventory

Most dealers would agree that acquiring inventory over the course of the past two years has grown more complex and difficult. We now understand that, if you want to maintain, if not grow, your share of money-making used vehicle sales, you can’t rely on trade-ins as much as you did in the past.

Similarly, while dealers still lean on auctions for inventory, they aren’t likely to find vehicles with substantial money-making opportunities, unless you’re buying vehicles that are four years old and older.

These market circumstances have led to a key question among dealers as we arrive at the mid-point of the current year—what are the best channels to source the most profitable inventory?

We can at least partially answer this question through inventory data that shows the sourcing channels where ProfitTime GPS dealers are vehicles with the highest investment values. (A quick refresher: ProfitTime GPS includes the Global Acquisition system, which measures and tracks where dealers acquire inventory, and shows how vehicles in each channel stack up based on their Bronze, Silver, Gold and Platinum investment value  designations.)

designations.)

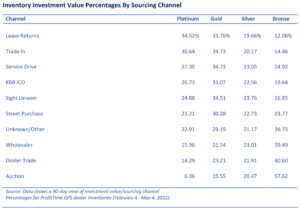

The chart at right shows what every dealer could likely guess correctly—lease returns and trade-ins provide inventory that possesses the highest investment values. Nearly two-thirds of the inventory acquired in these channels carry Gold and Platinum designations, the highest investment classes on ProfitTime GPS’ scale. But it’s also important to note that between the two channels, trade-ins account for a far higher share of inventory volume than lease returns (roughly 54 percent and 1 percent, respectively).

The inventory data also shows that vehicles acquired in the service drive and through Kelley Blue Book Instant Cash Offer also deliver a sizable share of higher investment value vehicles. Sixty-two percent of the vehicles acquired in the service drive are Gold and Platinum cars, while 58 percent of the KBB ICO-acquired vehicles are Gold and Platinum. Both of these channels suggest opportunity for dealers to source more high investment value vehicles: service drives account for 1.7 percent of overall inventory volume; for KBB ICO, it’s 3.4 percent.

The inventory data also suggests opportunity for dealers to acquire high investment value vehicles through the sight unseen and off-street purchase channels. Fifty-nine percent of the sight unseen-acquired inventory, and 53 percent of the off-street inventory, arrives as Gold and Platinum investments. There are more Gold than Platinum cars in these channels, and the channels tend to produce more inventory volume than the channels noted above (4.1 percent for sight unseen, and 2.7 percent for off-street).

I don’t think anyone will be surprised by the higher percentages of lower investment value vehicles at the bottom right of the chart. The data affirms what I hear in dealer conversations—there certainly aren’t as many great deals, or steals, across the inventory dealers acquire from auctions, other dealers and wholesalers.

As I’ve shared the ProfitTime GPS inventory data with dealers, I’ve been suggesting two steps to help them point their inventory acquisition efforts to the channels where better-value investments are more likely to occur:

Step 1: Avoid acquiring one-to-three-year-old vehicles at auctions if you can. Currently, wholesale prices for these vehicles are higher than retail prices. If you need these vehicles, you’ll be far better off, investment-wise, to step up your efforts to acquire late model units directly from customers through the trade-in, service drive, KBB ICO and sight unseen channels.

Step 2: Turn your lower-tier, Bronze-level investments as fast as possible. These vehicles are arriving in dealer inventories as distressed investments, and the market is returning to more normal trends of depreciation. The faster you get out of these vehicles, the faster you’ll reduce your risk and be able to redeploy the capital to another investment with higher yield potential.

My hope is that this inventory data will give dealers benchmarks they can use to know where they are more likely to find the best investment value vehicles and how to pursue these opportunities. After all, it’s the higher investment value vehicles that will help you hold your own if/when market conditions become less favorable in the months ahead.